Wu Ge Urges Government to Prioritize CPI Stability

"Achieving GDP Targets Doesn't Mean All Is Well - Stable CPI Also Matters"

Thank you my readers. I’ve passed 2000 subscriptions in a year, which greatly matters to me! Since China announced its retaliation measures toward the US last Friday, a lot of information has been sent by various Chinese media. I highly recommend reading two pieces among them, “Unwavering Commitment to Advancing High-Standard Opening-Up (坚定不移推进高水平对外开放)." published by Xinhua, and “Focus on Managing Our Own Affairs (集中精力办好自己的事)“ published by People’s Daily. Yuzhe HE has the English for the first one and Bill Bishop has the full English ver for the second.

These two set the tone for Chinese reactions and previewed some measures for stabilizing the economy. I believe that in response to extraordinary U.S. tariffs, China will also implement extraordinary economic stimulus measures to stabilize markets. And as the US returns to trade protectionism, it’s natural for China to more firmly open its market to the rest of the world.

monetary policy tools such as reserve requirement ratio cuts and interest rate reductions have ample adjustment room and can be introduced at any time. Fiscal policy has clearly stated the need to increase spending intensity and accelerate spending progress, with fiscal deficits, special bonds, and special national bonds having further expansion space as needed.

But what further enhancement can be done other than short-term stimulus and market opening? For today, I provide Dr.Wu Ge’s analysis. Currently the Chief Economist of Changjiang Securities, Wu previously worked for an extended period at the People's Bank of China—China's central bank—in the monetary policy department and served as an economist at the International Monetary Fund. He is also a recipient of the Sun Yefang Economic Science Award, China's highest honor in economics. He has participated in and delivered speeches at multiple economic symposiums hosted by the Chinese Premier.

This was originally a lecture he gave at the National School of Development at Peking University. He argues that while pursuing GDP growth, the government should pay more attention to CPI. Currently, there is a clear divergence between GDP growth rate and CPI; enterprises continue to produce in a low-price environment, yet this leads to insufficient market confidence; policy objectives focus too heavily on GDP growth while neglecting price stability and consumer confidence; past policies have failed to effectively promote price recovery, with price targets set too high and insufficient weight given to price considerations in actual policy implementation; meanwhile, the development of new technologies is not synchronized with demand-side expansion, potentially causing insufficient effective demand. He proposes that the government should increase the weight of CPI in decision-making and boost residents' economic confidence by promoting price recovery. Simultaneously, the government should stabilize residents' asset prices by stabilizing real estate prices and alleviating residents' concerns about consumption. In implementation, he emphasizes that stronger policy measures are necessary to shorten the adjustment cycle.

Below is the full text:

I am delighted to be here at the beautiful Chengze Garden in this most beautiful season to share my thoughts on China's economy. The subtitle of this report is "Interpreting the Spirit of the Two Sessions." At this special juncture, we need to consider: when policy objectives have already been established, what should academic discussions focus on? As an academic institution, Peking University bears the mission of imparting knowledge, teaching skills, and resolving doubts. Today, I want to especially emphasize "imparting knowledge" - this "knowledge" is not about specific policies, but rather about policy objectives. Is our goal merely the 5% GDP growth determined by the Two Sessions? Within the framework of high-quality development, while achieving quantitative growth targets, how can we continuously satisfy the aspirations of 1.4 billion people for a better life? How can we substantially improve business profit expectations? How can we boost consumer confidence? How can we translate economic recovery into tangible improvements in people's well-being? Finding good answers to these questions is no easy task.

Emphasizing Both GDP and CPI

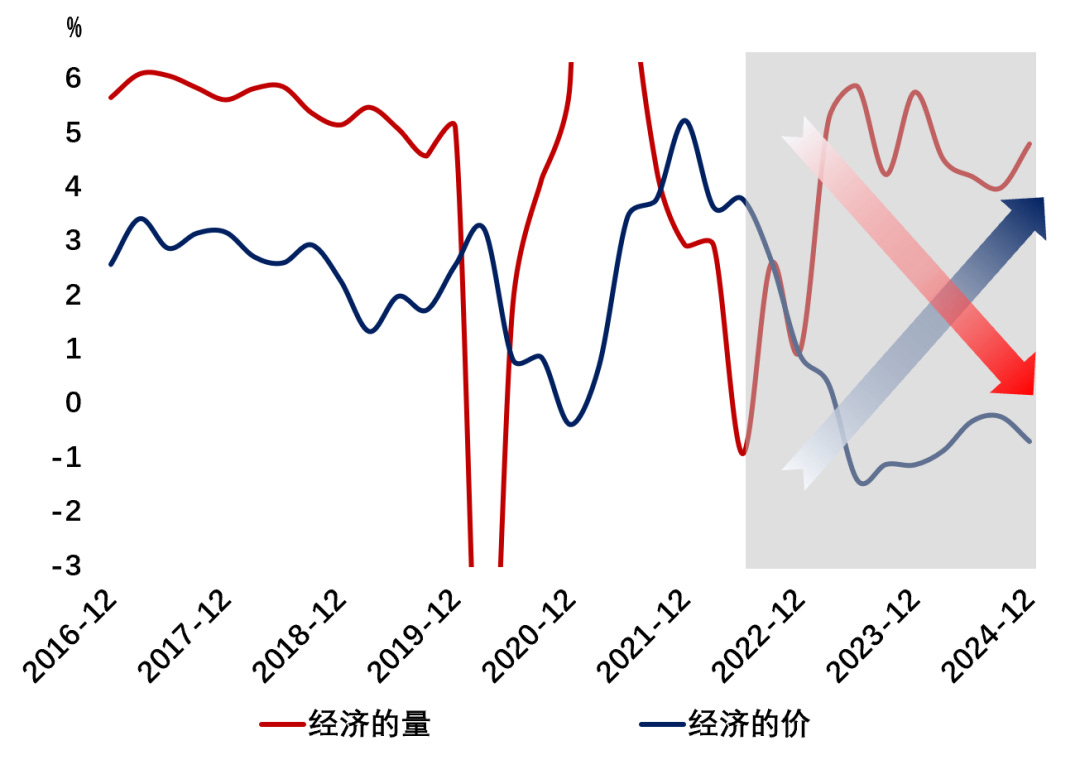

Recently, a phenomenon worth noting has emerged in China's macroeconomic sphere: as shown by the red line in Figure 1, in terms of the "quantity" dimension of economic growth, the actual GDP growth rate has consistently maintained within a reasonable range of around 5%. However, price indicators present a different picture. Core price indices such as CPI and PPI continue to run at low levels. Even when considering various price indices comprehensively, the current overall price level remains at a relatively low historical position. This "quantity-price divergence" phenomenon has begun to receive increasing attention from policymakers.

Notably, in previous growth cycles, when actual GDP growth reached its target, price indices would typically rise in tandem, and corporate profits would continuously improve. Today's divergence between GDP growth rate and price levels is unusual. Why has this occurred? Why has the central government recently incorporated "promoting moderate price recovery" into future policy objectives?

To answer these questions, we need to approach from a micro-perceptual perspective. In real economic operations, quantity and price are not naturally aligned. As shown in Figure 2, high-frequency economic indicators clearly reflect that many industrial and manufacturing enterprises share a common characteristic of "trading price for volume" - adjusting price strategies to gain market share. While this behavior can maintain business survival, continued price declines may weaken market confidence. Therefore, we hope to see a virtuous cycle of coordinated development between quantity and price, which would inject stronger confidence and momentum into the market.

Price is a crucial signal in a market economy; businesses expand production when they see prices rising. So why are some enterprises willing to "trade price for volume" and produce even at lower prices? In microeconomics, there's a scenario similar to the macroeconomic domain: facing continuously declining product prices, enterprises not only avoid reducing production but choose "counter-cyclical expansion." Behind this seemingly contradictory behavior lies precise cost calculation logic. According to microeconomic principles, as shown in Figure 3, when the selling price still exceeds variable costs, enterprises will choose to continue production even if they cannot cover fixed costs. Some highly competitive enterprises even reduce prices while expanding production. At this point, the business objective has shifted from "profit maximization" to "loss minimization."

This concept in microeconomics has a certain correlation with the quantity-price divergence in macroeconomics. We have compiled statistics on the status of some listed companies; in Figure 4, the blue solid line represents the market price or product selling price. The market price curve in Figure 4 has generally penetrated the total cost line of listed companies but remains higher than the variable cost line. Under such circumstances, companies will still choose to produce, which corroborates from another perspective that "quantity-price divergence" and "production at a loss" exist in the real economy.

Looking back at Japanese economic history, after the dramatic adjustment in the real estate market in 1990, as shown in Figure 5, the blue line representing real GDP performance remained stable, in stark contrast to the continuous decline of the GDP deflator represented by the red line. This "scissors gap" in economic indicators pushed decision-makers into a dilemma: when real GDP meets targets while prices remain persistently low, what direction should policy take?

There might be two solutions to this special economic form. One view is to maintain existing policy intensity, believing that safeguarding real GDP means safeguarding the economic foundation; another view is that we must recognize the reality of nominal GDP contraction and advocate for more aggressive stimulus policies.

How did Japan handle this issue back then? In the first decade after the real estate adjustment, the Bank of Japan had not yet established a clear price regulation mechanism. As long as real GDP maintained positive growth, the economic foundation was considered stable. However, with continuous corporate profit contraction and weakening confidence among micro-entities, Japanese decision-makers gradually realized that persistent price declines would damage the deep vitality of the economy. Subsequently, the Bank of Japan decided to anchor the price target between 0% and 1%. Practice proved that this approach did not significantly enhance residents' expected confidence. Later, Japan adopted the mature experiences of other countries, establishing a 2% inflation target as an unshakable rule, which was clearly defined as the "lower limit" rather than a "reference value" for price regulation, meaning that as long as CPI did not reach 2%, extraordinary monetary easing policies and fiscal stimulus would not cease.

After a long adjustment process, the Japanese concluded: First, economic health is not simply "positive growth equals safety." The economy is like the human body; normal body temperature is around 36 degrees, but that doesn't mean a body temperature above 0 degrees is healthy. Second, although the 2% inflation value is empirical data, it is very helpful in boosting people's expected confidence. These are experiences that Japan gained through long-term exploration.

Last year, our country's Two Sessions set the CPI target at 3%, but this year it has been adjusted to a more realistic 2%. The central government has also repeatedly emphasized attention to prices in various documents. Despite this emphasis, how much weight do prices actually carry in practical policy? As shown in Figure 6, for many years, the central government has consistently set the price target at 3%. In my view, this may be related to the multiple inflationary environments our country has faced during more than 40 years of reform and opening up. This 3% target seems to be viewed more as an upper limit rather than a lower limit that needs to be achieved. Last year, several leaders, including the governor of the central bank, mentioned multiple times promoting price recovery from low levels and pushing for moderate price increases. However, judging from subsequent price trends, although the leadership has given attention to this, the weight of prices in actual policy still needs to be increased.

From the perspective of econometric regression analysis, whether it's China's monetary policy rules or fiscal policy rules, the current weight placed on "GDP quantity" exceeds the weight on "price," and there is room for further increasing the weight of price. Looking ahead to 2025, if our goal is to achieve approximately 5% real GDP growth, this undoubtedly requires effort, but after a period of work, this target is achievable. However, if this year we want to achieve a positive GDP deflator, that is, greater than 0, this may require extraordinary policy strength to promote. The December 2024 Politburo meeting also mentioned adopting extraordinary countercyclical policies. Therefore, the key issue lies in the weight of the price target. If the price weight is small, we may only need routine efforts to achieve the 5% GDP growth target. If we have broader goals, including price considerations, then the required policy intensity may exceed the norm.

Strengthening Technological Innovation While Maintaining Supply-Demand Balance

The second topic we're discussing today is the development of new technologies. How should we understand the development of new technologies? Especially since this year, the capital market's enthusiastic response to new technologies like DeepSeek has not only boosted market confidence but also demonstrated our country's global competitiveness in this field. From a macro perspective, the essence of technological progress is a productivity shock, continuously enhancing national development momentum by improving supply capacity and total factor labor productivity.

China's excellent performance in the new wave of technological innovation is a recognized fact. Many people are curious about why DeepSeek was born in Hangzhou, but what I'm more interested in exploring is why it was born in China. The answer lies in the Chinese people's relentless pursuit of efficiency. The AI revolution represented by DeepSeek is essentially a profound reform on the supply side, with breakthrough innovations driving the supply curve to continuously shift rightward.

However, can the demand curve achieve simultaneous expansion? Say's Law proposes that "supply creates demand," suggesting that supply shocks can have far-reaching impacts on the demand side. Taking the United States as an example, as shown in Figure 7, over the past forty-plus years, U.S. labor productivity has continuously improved, while the proportion of labor income in GDP has been constantly declining. This indicates that when rapid expansion on the supply side encounters constraints on the demand side, it may create a gap of insufficient effective demand.

We were fortunate to find some data from England from two to three hundred years ago. As shown in Figure 8, you can see an interesting phenomenon: during several major industrial revolutions in England and globally, the social prices represented by the red lines generally showed a downward trend. This indicates that when technological development significantly drives the supply side and has a certain impact on the demand side, prices often decline. From a macro perspective, technological progress has, to some extent, played a role in reducing prices.

Of course, some might think these data are too outdated. Even focusing on recent data, this pattern still applies. As shown in Figure 9, taking China and the United States as examples, when other factors remain constant, as labor productivity rapidly improves, prices similarly show a downward trend.

Focus on Incremental Policies While Solving Stock Issues

The third issue discussed today involves the policy implementation level. During policy implementation, people's perception of policies is very important. Incremental policies are indeed a focus, but based on market observations in recent years, stock policies are equally important. For resident behavior, the impact of stock wealth and balance sheets on consumption cannot be ignored. To enhance residents' consumption propensity, besides incremental policies, we also need to address their concerns about stock wealth and balance sheets. Only in this way will residents actively respond to consumption policies. Therefore, in current policy research, we should focus not only on how incremental policies guide incremental behavior but also on the profound impact of stock effects on resident consumption.

Chinese residents' balance sheets are highly correlated with real estate price fluctuations. According to past statistics from the central bank, at least 60% of residents' stock wealth is closely related to real estate and housing prices. This year, the central government emphasized the importance of stopping the decline and stabilizing the real estate market, which concerns not only the healthy development of the industry but also the stability of the overall economic system.

Currently, we must comprehensively consider both incremental and stock policies, while taking into account both consumption and real estate. Consumption and investment are not isolated from each other. From this perspective, stronger measures need to be taken. The Japanese case provides valuable reference: after the real estate bubble burst in the 1990s, despite the Japanese government introducing new policies every year, weak policy intensity led to an extended adjustment cycle. Therefore, the strength and intensity of our country's policies are also very important.

The current policy design must not only precisely grasp the direction but also strengthen implementation intensity. It requires both nuanced counter-cyclical regulation and bold reform measures. Only in this way can we enhance public confidence and drive our economy toward a better new equilibrium.