Luo Zhiheng's Take on the Impact of the 15th Five-Year Plan on China's Fiscal System

Steering Growth, Stabilizing Localities, and Curbing Debt

Luo Zhiheng is the Chief Economist and President of the Research Institute at Yuekai Securities. He attended the economic symposium hosted by Premier Li Qiang in July 2023 and October 2024. He has also participated in multiple policy discussions organized by institutions, including the NPC, the National Development and Reform Commission, the Ministry of Finance, the PBoC, the China Securities Regulatory Commission, and the Ministry of Industry and Information Technology.

In the latest piece, Luo examines the latest developments and trends in taxation and spending in China’s upcoming 15th Five-Year Plan. The main idea is that the government is placing a greater emphasis on utilizing its budget to steer the economy and support people’s daily lives. The fiscal strategy needs to become more defined and actionable, which helps stabilize market expectations. This involves a transition in fiscal policy focus from emphasis on the deficit-to-GDP ratio towards managing the growth rate of expenditures and optimizing the overall structure of fiscal spending.

There’s also a big push to tackle local government financial difficulties. The plan suggests giving them more control over their budgets while moving some of their expensive responsibilities to the central government. On the tax side, it’s about shifting the system more towards direct taxation. And a top priority of this shift is creating a sustainable, long-term mechanism to manage government debt and prevent risks from piling up. (On Nov.3, the Ministry of Finance announced the establishment of a debt management department)

This piece is publicly available on Luo’s WeChat account. Below is the full translation

How to Understand the Fiscal and Tax Arrangements Proposed in the 15th Five-Year Plan?

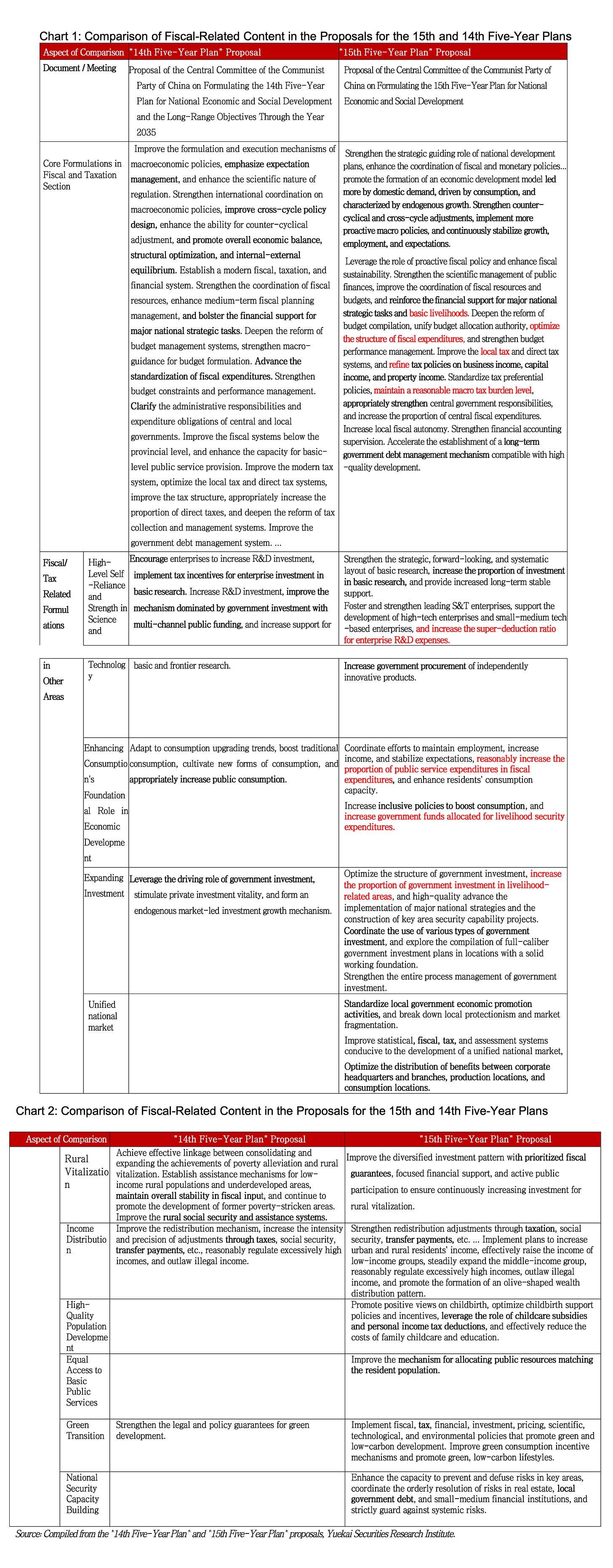

On October 28, the “Proposal of the Central Committee of the Communist Party of China on Formulating the 15th Five-Year Plan for National Economic and Social Development” (hereinafter referred to as the “15th Five-Year Plan” Proposal or the “Proposal”) was officially released. The Proposal includes important provisions for “enhancing the effectiveness of macroeconomic governance,” calling for the need to “implement more proactive macroeconomic policies,” “leverage the role of proactive fiscal policies and enhance fiscal sustainability,” “maintain a reasonable macro tax burden level,” and “accelerate the establishment of a long-term government debt management mechanism compatible with high-quality development.” These elements outline the main directions for optimizing fiscal policies and reforming the fiscal and tax systems during the “15th Five-Year Plan” period. This article compares the fiscal and tax policy arrangements in the “14th Five-Year Plan” Proposal, identifies four key characteristics of the fiscal and tax-related content in the “15th Five-Year Plan” Proposal, and subsequently analyzes the need to promote four major transformations in fiscal policy, deepen fiscal and tax system reforms to enhance fiscal sustainability, and establish a long-term debt management mechanism during the “15th Five-Year Plan” period.

Four Key Characteristics of the Fiscal and Tax Arrangements in the “15th Five-Year Plan” Proposal

Overall, the fiscal and tax arrangements in the “15th Five-Year Plan” Proposal reflect both the new demands placed on fiscal policies and the fiscal and tax system by the current domestic and international economic situation, as well as the continuity of the fiscal and tax system reform requirements established at the Third Plenary Session of the 20th Central Committee. A comparison with the “14th Five-Year Plan” Proposal reveals four key characteristics of the fiscal and tax-related content in the “15th Five-Year Plan” Proposal.

Overall, the fiscal and tax arrangements in the “15th Five-Year Plan” Proposal reflect both the new demands placed on fiscal policies and the fiscal and tax system by the current domestic and international economic environment, as well as the continuity of the fiscal and tax system reform requirements established at the Third Plenary Session of the 20th Central Committee. A comparison with the “14th Five-Year Plan” Proposal reveals four key characteristics of the fiscal and tax-related content in the “15th Five-Year Plan” Proposal.

First, the role of public finance as a “cornerstone and key pillar of national governance” has grown increasingly important, and its prominence in the five-year plan has increased accordingly. It will play a significant role in stabilizing growth, boosting momentum, improving livelihoods, and preventing risks. The fiscal and tax arrangements in the “15th Five-Year Plan” Proposal are woven throughout the document. They are not only specifically addressed in the section on “enhancing the effectiveness of macroeconomic governance,” which outlines the specific directions for fiscal policy and fiscal and tax system reform during the “15th Five-Year Plan” period, but are also explicitly emphasized in key areas and critical junctures such as technological innovation, income distribution, boosting consumption, expanding investment, building a unified national market, rural revitalization, high-quality population development, and green transformation. For instance, in the section on “resolutely breaking down bottlenecks hindering the construction of a unified national market,” it proposes to “improve statistics, fiscal and tax policies, and assessment systems conducive to the construction of a unified market, and optimize the sharing of benefits between corporate headquarters and branches, as well as between production and consumption locations.” In the section on “accelerating the formation of green production and lifestyles,” it calls for “implementing fiscal and tax, financial, investment, pricing, technological, and environmental policies that promote green and low-carbon development.” In contrast, fiscal and tax system reforms in the “14th Five-Year Plan” Proposal were subsumed under “establishing a modern fiscal, tax, and financial system” without a separate dedicated section, and other portions of the proposal made relatively fewer references to fiscal or tax measures.

Second, it explicitly proposes leveraging the role of proactive fiscal policies, placing greater emphasis on using fiscal policy to address short-term risks and challenges and maintain economic and social stability, in addition to medium- to long-term institutional reforms. Previous five-year plan proposals have generally focused on fiscal and tax system reforms with a medium- to long-term perspective and less emphasis on short-term policy directions. However, the “15th Five-Year Plan” Proposal calls for “strengthening counter-cyclical and cross-cyclical adjustments and implementing more proactive macroeconomic policies,” and correspondingly, for public finance, to “leverage the role of proactive fiscal policies” and play an important role in sustaining stable growth, employment, and expectations. This arrangement stems primarily from the significant shifts in the internal and external landscape during the “15th Five-Year Plan” period. Currently, the domestic economy faces “insufficient effective demand” and “arduous tasks in transforming old and new growth drivers,” while uncertainties and unforeseen factors such as major-power competition and geopolitics have increased substantially. Consequently, fiscal policy must adapt to the times and circumstances, playing a more substantial role in expanding aggregate demand, addressing economic and social risks, promoting self-reliance and strength in science and technology, and fostering integrated urban-rural development.

Third, there is stronger emphasis on fiscal policy “investing in people” and boosting consumption, highlighting the people’s livelihood dimension of the fiscal system in a major country. In the “15th Five-Year Plan” Proposal, fiscal content related to people’s livelihoods receives greater prominence. While the “14th Five-Year Plan” Proposal called for “enhancing financial support for major national strategic tasks,” the “15th Five-Year Plan” Proposal adds “basic living needs” (基本民生), proposing to “strengthen financial support for major national strategic tasks and basic living needs.” Other sections also clearly demonstrate a heightened focus on the household sector and boosting demand, representing a significant conceptual shift from the past relative emphasis on the corporate sector and investment. The “15th Five-Year Plan” Proposal puts forward specific measures such as “rationally increasing the proportion of public service expenditure in fiscal expenditure,” “increasing government funding for livelihood security expenditures,” “raising the proportion of government investment directed towards people’s livelihoods,” and “leveraging the role of childcare subsidies and personal income tax deductions to effectively reduce the costs of family childbirth, child-rearing, and education.” These clearly signal that during the “15th Five-Year Plan” period, public finance will prioritize increasing both the scale and proportion of expenditure on people’s livelihoods, reducing the burden on residents and families, addressing widespread public concerns regarding pain points in areas like education, healthcare, elderly care, and child-rearing, and comprehensively enhancing residents’ sense of well-being and consumption capacity.

Fourth, the objectives of fiscal-related policies or reform arrangements are more clearly defined, policy orientation is sharper, and policies are more actionable, which helps stabilize expectations. On the one hand, the fiscal-related content in the “15th Five-Year Plan” Proposal generally serves two overarching objectives: promoting dynamism (”domestic demand-led, consumption-driven, and endogenous growth”) and stabilizing development (”sustaining stable growth, employment, and expectations”). The call to “implement more proactive macroeconomic policies” clearly signals that China will continue to implement more proactive fiscal policies during the “15th Five-Year Plan” period. The overall objectives are well-defined, and the policy orientation is clear-cut. On the other hand, the deployment of fiscal-related policies in key areas is highly actionable, with clear policy priorities and relatively specific policy instruments. For example, it explicitly proposes to “support the development of high-tech enterprises and small and medium-sized sci-tech enterprises, and increase the super-deduction ratio for enterprise R&D expenses,” which is more concrete than the “encourage enterprises to increase R&D investment” in the “14th Five-Year Plan” Proposal. In the section on boosting consumption, the “15th Five-Year Plan” Proposal explicitly proposes measures such as “rationally increasing the proportion of public service expenditure in fiscal expenditure” and “increasing the intensity of inclusive policies directly reaching consumers.” The section on expanding investment sets the goal to “raise the proportion of government investment directed towards people’s livelihoods.” The corresponding expressions in the “14th Five-Year Plan” Proposal were comparatively more general. Replacing relatively vague policy statements with clearer policy directions not only clarifies the focal points and key levers for fiscal efforts during the “15th Five-Year Plan” period but also helps guide the policy expectations of microeconomic entities and boost the confidence of enterprises and residents.

II. To Better Leverage the Role of Proactive Fiscal Policy, Four Transformations in Fiscal Policy Are Needed

The Proposal calls for “implementing more proactive macro policies,” “leveraging the role of proactive fiscal policy,” “strengthening the scientific management of public finances, enhancing the coordination of fiscal resources and budgets, and reinforcing financial support for major national strategic tasks and basic livelihoods. Deepening zero-based budgeting reform, unifying budget allocation authority, optimizing the structure of fiscal expenditures, and strengthening budget performance management.” During the “15th Five-Year Plan” period, China’s economy will still largely be in a transitional phase of shifting growth drivers, facing substantial downward pressure. Proactive fiscal policy is a crucial instrument for underpinning the macroeconomy and stabilizing the overall development trajectory. Fiscal policy needs to achieve four transformations.

First, shift from a previous overemphasis on the deficit-to-GDP ratio to focusing on expenditure growth rates, breaking free from the 3% deficit ratio constraint, ensuring adequate expenditure intensity, and enhancing the counter-cyclical adjustment role of fiscal policy. The “15th Five-Year Plan” proposal calls for “implementing more proactive macro policies” and “leveraging the role of proactive fiscal policy.” This requires maintaining a certain growth rate in fiscal expenditures, reasonably determining the actual deficit ratio level based on economic and social development needs, and gradually adopting a full-caliber deficit and deficit ratio based on all fiscal revenues and expenditures to measure the proactiveness of fiscal policy.

Second, transition from emphasizing tax and fee cuts on the revenue side to prioritizing expenditure expansion on the spending side, shifting revenue policies from a quantity-scale model to an efficiency-effectiveness model. Expanding fiscal expenditures can directly boost aggregate demand, thereby increasing household and business income. For revenue policies, the focus should be on streamlining and standardizing tax incentives, improving the precision of tax incentive policies in key areas and critical junctures (such as technological innovation, small and micro enterprises, encouraging childbirth, etc.).

Third, further optimize the structure of expenditure-side policies, shifting from a focus on supply, investment, and enterprises to balancing supply and demand, investment and consumption, and enterprises and households. Past expenditure policies operated more heavily on the supply side, the enterprise side, and the investment side, primarily because the main task during the stage of a shortage economy and insufficient supply was to increase supply. Currently, the Chinese economy has entered a stage of insufficient demand, requiring adjustments in the objectives and methods of macroeconomic regulation and control. Fiscal support policies need to pivot towards demand and households, improving the social welfare level of the household sector. On one hand, optimize the direction of government investment, investing in people and in new quality productive forces. The “15th Five-Year Plan” proposal suggests “increasing the proportion of government investment in livelihood-related areas.” Future government investment should be linked to population flows, meeting the production and living needs of the mobile population; linked to demographic structure, increasing the supply of high-quality elderly care service facilities; linked to security considerations, increasing efforts to renovate and upgrade old residential areas, urban underground pipe networks, flood control facilities, etc.; and linked to unlocking economic growth potential, providing more support for new types of infrastructure such as information infrastructure, integrated infrastructure, and innovation infrastructure. On the other hand, make greater efforts to boost consumption, building China into the world’s largest consumer market. Against the backdrop of profound changes unseen in a century, comprehensively expanding domestic demand, especially addressing the consumption shortfall, has become even more urgent. This requires building a consumption-oriented fiscal, tax, and policy framework to promote supply-demand rebalancing. The “15th Five-Year Plan” proposal calls for “reasonably increasing the proportion of public service expenditures in fiscal expenditures to enhance residents’ consumption capacity.” This means strengthening investment in livelihood areas, increasing subsidies for specific groups (unemployed youth, low-income urban and rural populations, families with multiple children, etc.), increasing fiscal investment in elderly care and healthcare, and increasing expenditures on education and affordable housing to improve the risk resilience and consumption willingness of the household sector.

Fourth, better leverage the role of fiscal policy in expectation management, and, if necessary, change the terminology from “proactive fiscal policy” to the more explicit “expansionary fiscal policy.” Clarify the current meaning of “proactive” in fiscal policy, and change it to “expansionary fiscal policy” if necessary, to send a clearer signal. Theoretically, effective fiscal policy can keep economic growth within a reasonable range above the real interest rate. In the long run, there is no need for excessive concern about debt sustainability; debt risks can only be gradually resolved within the context of stable economic development. During the “15th Five-Year Plan” period, China’s overall government debt-to-GDP ratio remains relatively low, and with the ongoing decline in nominal interest rates, the government’s debt servicing costs are continuously decreasing, further expanding the room for implementing an expansionary fiscal policy.

III. Deepening Fiscal and Tax System Reform, Enhancing Fiscal Sustainability, and Preventing a Renewed Decline in the “Two Ratios”

The Proposal calls for “enhancing fiscal sustainability,” “improving the local tax and direct tax systems, refining tax policies on business income, capital income, and property income, standardizing tax preferential policies, and maintaining a reasonable macro tax burden level,” “appropriately strengthening central government responsibilities and increasing the proportion of central fiscal expenditures,” and “increasing local fiscal autonomy.”

(I) Enhance fiscal sustainability, standardize tax incentives, and stabilize the macro tax burden.

Currently, the macro tax burden is declining continuously, and fiscal revenue capacity is relatively weak. When fiscal revenue capacity is insufficient and fiscal expenditures are difficult to reduce, a declining macro tax burden implies rising government debt, which undermines long-term fiscal sustainability. The “15th Five-Year Plan” proposal explicitly calls for “enhancing fiscal sustainability.” The core of enhancing fiscal sustainability lies in improving government debt sustainability, which requires both enhancing the effectiveness of fiscal policy and perfecting the government debt management mechanism. This is a long-term, systematic undertaking. The immediate priority is to stabilize the macro tax burden level, prevent a recurrence of both “two ratios” (the ratio of fiscal revenue to GDP, and the ratio of central fiscal revenue to total fiscal revenue) falling simultaneously, and on this basis, further work toward maintaining a reasonable macro tax burden level. During the “15th Five-Year Plan” period, it is necessary, building on the effective implementation of existing tax and fee reduction policies, to structurally adjust and optimize the existing stock of tax and fee reduction policies, place greater emphasis on policy precision and efficiency, and keep the macro tax burden fundamentally stable. First, unnecessary tax incentives should be streamlined, and the precision of tax incentive policies in key areas and critical junctures (e.g., technological innovation, small and micro enterprises, encouraging childbirth) should be improved; tax incentives introduced during an industry’s infancy should be phased out in a timely manner once the industry matures, to avoid distorting industry competition costs and causing overcapacity; “tax havens” illegally and improperly established by local governments must be resolutely corrected. Second, pursue structural adjustments to the tax burden for taxes that have minimal impact on ordinary residents but are conducive to promoting green development and narrowing the wealth gap. Third, promptly research and explore new tax sources in line with economic development conditions, such as studying digital asset taxes, carbon taxes, inheritance and gift taxes, etc.

(II) Increase local fiscal autonomy, shift administrative responsibilities and expenditure obligations upward, and focus on resolving local fiscal difficulties.

The fundamental reason for recent difficulties in local fiscal operations lies in the long-standing problem of excessive administrative responsibilities and expenditure obligations at the local level, coupled with an insufficiently scientific and standardized division of revenue between the central and local governments, resulting in inadequate local fiscal resources, especially local autonomous fiscal capacity.

Shift administrative responsibilities and expenditure obligations upward to alleviate the situation where local governments are operating as “a small horse pulling a big cart.” Areas such as equalization of basic public services, social security, natural resource security, grain and oil reserves, financial regulation, cross-regional construction or public services, environmental protection, and basic research should see their responsibilities further centralized at the central government level; promote the transformation of central government functions, strengthen vertical management and departmental consolidation, and enhance the direct expenditure responsibilities of central departments; establish a dynamic adjustment mechanism for the division of central and local administrative responsibilities and expenditure obligations.

Actively expand local tax sources, with the core objective of enhancing local fiscal autonomy to increase local independent financial resources, and improve the local revenue system primarily based on shared taxes. In the short term, the sharing ratios of shared taxes like corporate income tax and personal income tax can be appropriately optimized to quickly alleviate local fiscal operational difficulties and help local finances transition from an emergency state back to normal operations. In the medium to long term, the focus should be on enhancing local fiscal autonomy to increase local independent financial capacity, giving localities more latitude for independent allocation of financial resources. Coupled with the upward shift of responsibilities and expenditure obligations, this should gradually align local fiscal capacity with their responsibilities and expenditure obligations. For example, optimize the tax system design of existing major local taxes and appropriately expand local tax management authority, granting local governments more autonomous decision-making space; and, under the premise of standardizing non-tax revenue management, appropriately delegate certain non-tax revenue management authority.

(III) Improve tax policies on business, capital, and property income, enhance the direct tax system, and strengthen the alignment of the tax system with high-quality development.

Currently, China’s major taxes face issues such as unclear positioning between revenue collection and economic regulation, complex preferential policies, and unreasonable tax bases and rates. The overall effectiveness of the tax system in serving high-quality development requires further improvement, necessitating resolution during the deepening of fiscal and tax system reform in the “15th Five-Year Plan” period.

First, use personal income tax as the primary lever to enhance the direct tax system. On one hand, persistently advance personal income tax reform following the principle of “broad tax base, low tax rate, strict collection and administration.” During the “15th Five-Year Plan” period, maintain the personal income tax basic deduction threshold unchanged, gradually incorporate business income, property income, capital income, etc., into comprehensive income, moving steadily towards a fully comprehensive income tax system; moderately reduce the top marginal tax rate for comprehensive income to improve tax compliance, while strengthening collection and administration for new economic activities like live streaming and excessively high-income groups such as entertainment stars; establish a mechanism for dynamic adjustment of personal income tax deduction amounts based on price levels, etc. On the other hand, improve other direct tax systems, such as researching the feasibility and necessity of introducing inheritance and gift taxes.

Secondly, optimize the functional positioning of VAT, improve the VAT system, and enhance tax neutrality. In future reforms, further strengthen the revenue-raising function of VAT as the largest tax category, reduce its regulatory functions, and eliminate unnecessary VAT incentives; improve the VAT deduction chain to enhance its neutrality.

Thirdly, enhance tax collection and management capabilities, and reduce taxes levied directly on enterprises to alleviate their perceived tax burden. Moving the collection point of consumption tax downstream is one feasible approach, provided collection and administration are manageable. Shifting the collection point for certain consumption tax items to the retail stage reduces taxation at the production stage and alleviates the perceived tax burden on enterprises.

Fourth, establish a tax system adapted to new business models under the digital economy. Categorize various digital business models and clarify tax subjects; strengthen platforms’ information disclosure obligations; prudently research and explore new taxes such as digital asset taxes; deepen the reform of the tax collection and administration system, strengthen tax collection for new business models, and reduce tax erosion.

IV. Accelerate the Establishment of a Long-Term Government Debt Management Mechanism Compatible with High-Quality Development, and Contain Local Government Debt Risks

The Proposal calls for “accelerating the establishment of a long-term government debt management mechanism compatible with high-quality development” and “enhancing the capacity to prevent and defuse risks in key areas, coordinating the orderly resolution of risks in real estate, local government debt, and small and medium financial institutions, and strictly guarding against systemic risks.” Currently, significant progress has been made in preventing and resolving debt risks, but the long-term mechanism remains under construction. Local debt risks, especially hidden debt risks, remain noteworthy for various reasons.

First, debt resolution pressure remains elevated in some regions. Short-term liquidity challenges faced by local governments, especially arrears to enterprises, have not been fundamentally resolved, leaving insufficient time and energy to build a medium- to long-term mechanism for debt risk prevention and resolution.

Second, China’s economy is still in a phase of shifting growth drivers, the economic development model has not completely transformed, and the development mindset of some local governments that relies on investment to drive growth has not fundamentally changed.

Third, there is currently a lack of a full-caliber government debt management mechanism and a dynamic debt risk monitoring mechanism, making it difficult to accurately assess the level of hidden debt risk.

The key to building a long-term government debt management mechanism compatible with high-quality development lies in establishing hard budget constraints for local governments and fundamentally containing local government debt risks. Besides the fiscal system reforms centered on “shifting financial resources downward and administrative responsibilities upward” mentioned earlier, efforts can be directed toward six areas:

Establish a full-caliber local government debt monitoring system and a dynamic debt risk early warning system; strengthen the assessment of the long-term sustainability of local government debt; enhance debt information transparency and improve external supervision mechanisms. The full-caliber local government debt monitoring system should cover all explicit local government debt and also include debts raised by urban investment companies (UICs) for participating in government quasi-public welfare projects, social financing in PPP projects, etc. Regularly and comprehensively disclose full-caliber local government debt situations, promote the “surfacing” of hidden debts, improve the openness and transparency of local government debt information, and strengthen public oversight.

Improve the central government’s assessment mechanism for local governments, clarify the weight distribution under multiple objectives, strictly implement the accountability mechanism while adding positive incentives. Local governments currently face numerous assessment targets, including economic development, environmental protection, rural revitalization, risk prevention and resolution, etc. Multiple objectives imply a wider range of fiscal expenditure responsibilities, potentially leading to risks where local financial capacity cannot cover expenditure responsibilities, increasing hidden debt. Strictly implement the lifelong accountability system for local government borrowing and the backward investigation mechanism for debt problems. Strengthening accountability needs to be combined with reforms of the cadre personnel assessment system to better leverage the superior’s directive role in the preemptive and ongoing prevention and control of local government debt risks. But simultaneously, it is necessary to exert the role of positive incentives, encouraging local governments to take proactive actions to prevent and resolve risks.

Improve the mechanism where investment determines financing, achieving a pattern where central government bonds, local general bonds, local special bonds, and urban investment bonds (UIBs) each fulfill their designated roles. Investments whose benefits are nationwide or have cross-provincial externalities should be financed by central government bonds; local government investments in non-profit public welfare projects without revenue should make bold use of local general bonds rather than special bonds, avoiding the use of special bonds solely due to concerns about raising the deficit ratio; local government investments in projects with some revenue should use special bonds and need not be implemented by UICs issuing UIBs.

Accelerate the shift of the economic development model from debt and investment-driven to technology and consumption-driven. Accelerate the transformation of the economic development model, and establish technology-driven and consumption-oriented statistical, fiscal, tax, and assessment mechanisms.

Establish standardized capital budgets and debt budgets to strengthen hard budget constraints for local governments. Preparing capital and debt budgets helps better assess the impact of government investment projects on government debt sustainability, facilitates communication and coordination among government investment authorities, finance departments, and functional departments in specific areas, and helps strengthen the effective management of state-owned assets to prevent their loss. In the long run, an accrual-based comprehensive government financial reporting system should be improved on this basis to comprehensively report the government’s assets, liabilities, revenues, expenditures, etc.

Actively promote the transformation of local financing platforms (LFPs), building a firewall between fiscal risks and market risks. Classify and implement the cancellation, consolidation, or transformation of UICs based on their degree of marketization and regional resource endowment, reducing the number of financing platforms; encourage platform companies to broaden financing channels and reduce financing costs through methods like asset securitization and introducing private capital; improve market-oriented operation mechanisms to enhance their self-sustainability; strengthen supervision and guidance of platform companies to ensure a smooth and orderly transformation process that does not trigger new debt risks.