Jiang Xiaojuan on China's Economic Strategy: Next Stage of Reform, and US Relations

Former Deputy Secretary-General of China's State Council on Market Exit Systems, "Involution," and Navigating Global Competition

Hello, my readers, for today's episode, I bring you the latest speech from Jiang Xiaojuan (江小涓), a distinguished scholar-official whose unique dual perspective makes her insights particularly valuable. As both a renowned economist and experienced policymaker, she embodies the rare combination of academic research and hands-on governance experience.

Jiang served as Deputy Secretary-General of the Chinese State Council between 2011 and 2018, one of the highest positions in China's policy-drafting. In this role, she was directly involved in formulating and implementing major economic policies. Prior to her government service, she established herself as a leading academic voice on industrial economics and development policy at the Chinese Academy of Social Sciences.

After leaving the State Council in 2018, she returned to academia as Dean of the School of Public Policy and Management at Tsinghua University, a position she held until 2022.

Jun.21, she gave a speech at the Mid-Year Forum of China Macroeconomy Forum 2025, during the speech, Jiang outlined three key priorities: making every effort to maintain the economy's upward momentum, enhancing endogenous momentum through advancing reform and opening up, and expanding China's opening-up policies. She particularly stressed the importance of landmark reform measures, including improving enterprise bankruptcy mechanisms and market exit systems to address "involutionary" competition. On China-US economic relations, she argued that considerable negotiation space still exists despite current tensions, noting that China's trade diversification has reduced dependence on the US market while globalization continues to advance, particularly driven by digitalization.

Here are some interesting parts I feel need to highlight:

About using text research in Chinese policy studies

我到了清华后,发现公共管理学院有一个文本研究的特点,因为公共管理学院研究政府政策,就要看政府政策中哪句话说得多,就觉得政府重视这件事情。我刚去特别接受不了,我说了多少遍做不到所以不断地说,不见得就是重视。

After joining Tsinghua, I discovered that the School of Public Policy and Management has a text research characteristic. Since the school studies government policy, researchers examine which phrases appear frequently in government policies, believing that frequency indicates government priorities. Initially, I couldn't accept this approach, thinking that repeating something multiple times because it's difficult to achieve doesn't necessarily indicate priority.

Regarding the cause of overcompensation:

Incomplete market mechanisms prevent survival of the fittest. We've long focused heavily on encouraging market entry while lacking proper exit mechanisms. When one enterprise suffers losses, then two enterprises suffer losses, then the entire industry suffers losses—many experts argue that market economies naturally have oversupply. However, when oversupply reaches the point where entire industries suffer losses but still can't exit, there must be institutional design problems.

About the competition with the US

When they (Multinational Enterprise) come to China, they see such a large market with excellent industries, components, and processing chains that they can't bear to leave. They tell our leaders that China is very important and they'll certainly maintain friendly relations with us. Returning to America, they tell Congress that China must be contained, or there'll be no room for competition. There are too many examples, and they don't hide it. Currently, major powers worldwide have no conspiracies—everything is on the table, and everyone sees very clearly. This is the basic logic of intensified competition, not directly related to who's in power or out of power. It's just that some people act without method—that's the only way to describe it—they don't know how to act properly. They didn't devise this themselves; it's caused by fundamental changes.

Below is the full text. Don’t hesitate to share and like it if you think this piece is useful.

Below is the full text:

I. Making Every Effort to Maintain the Economy's Upward Momentum

We typically view reform as a long-term economic driving force, but now these policies are extremely important in the short term. I won't elaborate on the first point since macroeconomic policies have already been announced. The main focus is on the data that came out in May, which looked fairly good. The rightmost column shows mostly first-quarter data, though some data from January to May is also available. Retail sales remain quite strong, but fixed asset investment and several major real estate indicators appear mediocre. Export performance this year has been relatively good. The social consumption issues we're concerned about show some progress, while other indicators are generally stable.

Regarding the (policy) deployment from the April 25 Politburo meeting, let me briefly share my observations. There are many new elements. The red sections in the chart represent broad policies that affect every level of the macroeconomy—investment, consumption, and exports. Blue represents consumption-related policies, and purple represents investment-related policies. The policy mix is relatively balanced.

PS: Red include

统筹国内经济工作和国际经贸斗争……着力稳就业、稳企业、稳市场、稳预期…创设新的结构性货币政策工具,设立新型政策性金融工具…..要多措并举帮扶困难企业。加强融资支持……加快解决地方政府拖欠企业账款问题…..对受关税影响较大的企业,提高失业保险基金稳岗返还比例….要不断完善稳就业稳经济的政策工具箱,既定政策早出台早见效,根据形势变化及时推出增量储备政策

Coordinate domestic economic work and international trade struggles... focus on stabilizing employment, stabilizing enterprises, stabilizing markets, and stabilizing expectations... create new structural monetary policy tools, establish new policy-oriented financial instruments... take multiple measures to assist enterprises in difficulty. Strengthen financing support... accelerate resolution of local government payment arrears to enterprises... for enterprises significantly affected by tariffs, increase the proportion of unemployment insurance fund job stabilization refunds... continuously improve the policy toolkit for stabilizing employment and the economy, implement established policies early for early results, and promptly launch incremental reserve policies in response to changing circumstances.

Blue includes:

扩大消费….尽快清理消费领域限制性措施,设立服务消费与养老再贷款

Expand consumption... promptly eliminate restrictive measures in the consumption sector, establish service consumption and elderly care re-lending facilities.

purple includes:

支持科技创新….稳定外贸….培育壮大新质生产力,打造一批新兴支柱产业。持续用力推进关键核心技术攻关,创新推出债券市场的“科技板”,加快实施“人工智能+”行动。

Support technological innovation... stabilize foreign trade... cultivate and strengthen new quality productive forces, develop a number of emerging pillar industries. Continue vigorous efforts to advance breakthroughs in key core technologies, innovatively launch a "technology board" in the bond market, accelerate implementation of "AI+" initiatives.

Take consumption, for instance. We've indeed discussed it extensively, but facing so many new technologies, particularly AI technology, the competition was merely technological before DeepSeek and didn't translate into comprehensive industrial upgrading. However, since then, industrial applications have become routine. Previously, only a few large financial institutions had the capital and technical capabilities to develop large models independently, creating relatively high barriers.

DeepSeek's breakthrough advantage lies in requiring no secondary training or external knowledge bases, offering flexible deployment that can quickly adapt to various industry needs. It has become a deployable industrial upgrade tool with broad penetration potential. DeepSeek has lowered AI application barriers, providing an efficient upgrade path for all industries. Missing this technological window due to insufficient investment could lead to a competitive disadvantage.

Therefore, in the "4.25" framework, we made comprehensive deployments for macroeconomic policy, consumption, and investment, utilizing all available policy measures in a multi-pronged approach.

What draws considerable attention goes beyond "4.25"—this year's Two Sessions and last year's Central Economic Work Conference emphasized the people-centered orientation of macroeconomic policy, which is interpreted as a consumption focus. However, this isn't necessarily entirely accurate. For instance, “Investing in People” represents a concept that coordinates investment and consumption. The real estate market has gained considerable policy flexibility in both inventory and new supply management, giving city governments greater autonomy over purchase entities, pricing, and usage. We previously restricted new villa construction, but now we've changed the criteria to "safe, comfortable, green, and smart quality housing." As long as there's market demand—and indeed, the highest-end properties sold best everywhere last year—this represents a very comprehensive policy adjustment.

Comparing the three years of economic work conferences since the end of the COVID-19 pandemic in late 2022, what changes do we see?

First, the change in quality and quantity emphasis. When we discuss high-quality development and keep using this term, people might think high-quality development only concerns quality. "Promoting effective quality improvement and reasonable quantitative growth in the economy"(推动经济实现质的有效提升和量的合理增长)—this was the exact wording from the 2022 Economic Work Conference. In 2023, we spoke of "focusing on economic construction as the central task and high-quality development as the primary objective"(聚焦经济建设这一种新工作和高质量发展这一首要任务), combining these two elements, which still sends an important signal. The recent formulation states: "Quality improvement and reasonable quantitative growth must be unified throughout the entire process of high-quality development."(要把质的有效提升和量的合理增长统一于高质量发展的全过程) Years ago, when we emphasized quality, we mentioned that both quality and quantity should drive growth rates upward.

Second, maximizing the potential of the "three engines." Since last year, I've consistently argued that this represents the central government's true policy intention. Previously, we emphasized expanding domestic demand and prioritizing consumption recovery and expansion. During the pandemic, our consumption was particularly sluggish, so this emphasis was correct. However, in recent years, we've addressed both sides: "Focusing on expanding domestic demand, we must stimulate consumption with potential and expand beneficial investment to form a virtuous cycle of mutual promotion between consumption and investment."(着力扩大国内需求,要激发有潜能的消费,扩大有效益的投资,形成消费和投资相会促进的良性循环。) You can't invest recklessly—it must be beneficial. This year: "Vigorously boost consumption, improve investment efficiency, and comprehensively expand domestic demand."(大力提振消费、提高投资效益,全方位扩大国内需求) We must fully understand the central government's policy requirements. All policies should serve growth. The policy combination approach has been discussed for several years.

Looking very directly at the elevated position of economic growth in central policy. After joining Tsinghua, I discovered that the School of Public Policy and Management has a text research characteristic. Since the school studies government policy, researchers examine which phrases appear frequently in government policies, believing that frequency indicates government priorities. Initially, I couldn't accept this approach, thinking that repeating something multiple times because it's difficult to achieve doesn't necessarily indicate priority. Later, I found this approach has merit. The left side of the chart shows the 2019 Government Work Report. They examine word frequency and positional importance in government work reports, combining these with three other indicators to create what we call a "word cloud"—frequent mentions indicate importance. In 2019, the key terms were "high-quality development," "market entities," and "small and micro enterprises." In 2025's Government Work Report: "economic growth" and "high-quality growth." Indeed, "quality" and "speed" have become equally weighted top-level objectives. This is a common method used by policy researchers, and borrowing it slightly, we can see that new objectives are indeed being emphasized.

The overall economic stabilization and recovery remain promising. Given today's significant changes in the external and international environment, we can still expect a trend toward stability and improvement. For the second half of this year, we can anticipate momentum for medium-term stable growth.

II. Enhancing Endogenous Momentum: Advancing Reform and Opening Up

While medium and long-term growth requires endogenous momentum, short-term growth needs it too. Let's examine which measures are particularly urgent and consider opening-up issues briefly.

First, landmark reform measures must be implemented effectively. This is a clear central requirement. Some deployments from the Third Plenum, last year's Economic Work Conference, and this year's Politburo meetings emphasize certain reforms. What do they really mean? The state-owned enterprise reform, SOEs are a distinctive feature of China's system, but this year we've discussed "guidance for SOE layout and structural adjustment," which represents quite an important requirement. During the Fourth Plenum of the 15th Central Committee in 1999, we mentioned that the state-owned economy should advance in some areas and retreat from others, identifying four sectors at that time. "Retreat" meant withdrawing from general economic sectors—this was in the central document. Despite various fluctuations and discussions since then, the 20th Central Committee's Third Plenum again specified which areas to advance into, without mentioning retreat but clearly indicating advancement: promoting state capital concentration in important industries and key sectors related to national security and the national economic lifeline, in public services, emergency capabilities, and public welfare sectors related to national welfare and people's livelihood, and in forward-looking strategic emerging industries.

This essentially covers areas where private enterprises are unwilling or unable to perform well, or simply don't want to engage. The implication is clear: fulfill strategic missions—it's not necessarily better to be bigger or do more. This represents a very important reform measure.

We must accelerate the establishment of fundamental rules and systems. The Third Plenum mentioned improving corporate bankruptcy systems, which I personally place in a particularly high position within the Third Plenum's reform agenda. For so many years in market competition, "streamlining administration and delegating power" reforms and market environment liberalization have all aimed to minimize entry barriers—from three months to one month to one week to one day to instant approval. We wish that anyone wanting to enter a market could do so immediately, making entry channels extremely smooth and seamless.

Generally speaking, with large entry points and extensive support for participating enterprises, market survival of the fittest should occur. However, the "fittest" exit mechanism is particularly constrained—not because it's prohibited, but because specific arrangements are extremely difficult. Individual exits require enormous effort because there are no specific procedures for debt repayment, employee compensation, or bank handling. Without specific regulations, each case must be handled individually. Therefore, poor exit mechanisms represent a fundamental institutional deficiency underlying our discussions of overcapacity and "involution" over the years.

Therefore, the Third Plenum's emphasis on improving corporate bankruptcy mechanisms, exploring personal bankruptcy systems, advancing supporting reforms for enterprise deregistration, and perfecting enterprise exit systems represents particularly important institutional arrangements. When the economy shifts toward stock competition, overall efficiency must be improved through factor reorganization (optimizing allocation of resources, technology, capacity, etc.), but this requires eliminating inefficient enterprises to release market share. Without elimination mechanisms, advantaged enterprises cannot obtain sufficient resources and market space, hindering industrial upgrading and efficiency improvement. This represents particularly important institutional arrangements and a very significant issue.

The General Secretary pointed out that the private economy is particularly important. After the "2.27" private enterprise symposium, private enterprises felt that information from all aspects was particularly accurate—what they can do, what they want to do, long-term expectations, and resolution of lingering problems all showed fundamental improvements.

Promoting private economic development—private enterprises are most concerned about these issues:

First, fair competition. Since the Fourth Plenum of the 16th Central Committee, we've emphasized 16 characters: "fair access, equal competition, equal protection"(公平准入、平等竞争、同等保护)—fair market entry, equal competition, and equal legal protection. However, there are certainly still some problems in practice. We've recently re-emphasized fair competition issues, including points of particular concern to enterprises. One is a major national investment project. With the high proportion of national investment now, excluding private enterprises would obviously be unfair. We particularly emphasize major technology projects, which involve substantial funding, and private enterprises not being able to access these opportunities is also unfair. Current measures target problems that enterprises report as particularly prominent.

Second, payment arrears. This has been discussed extensively, so I won't elaborate. After all the back-and-forth, the main entities suffering from arrears are private enterprises.

Regarding "involutionary" competition, this ultimately concerns regulating local government and enterprise behavior. So-called "involutionary" competition means enterprises competing by lowering prices at the survival margin. Low prices affect the PPI (Producer Price Index). The January-May PPI performance wasn't particularly good—there's no choice, as enterprises face death without price cuts. They hope to outlast others and survive themselves, making price competition particularly difficult to avoid under current circumstances. Low prices, poor PPI performance, weak corporate profits, insufficient investment, poor confidence, and weak long-term expectations—this represents a significant problem with multiple causes:

(1) Economic deceleration and shrinking domestic and international markets force enterprises to face more intense market competition.

(2) The digital era is developing particularly rapidly. Previously, we said that among 10 startups, 1-2 would survive. Now this ratio doesn't exist at all. In digital-sector venture capital, companies become unicorns and immediately apply for listing, while failure can happen overnight. Therefore, the digital era's rapid technological iteration significantly impacts enterprises.

(3) Incomplete market mechanisms prevent survival of the fittest. We've long focused heavily on encouraging market entry while lacking proper exit mechanisms. When one enterprise suffers losses, then two enterprises suffer losses, then the entire industry suffers losses—many experts argue that market economies naturally have oversupply. However, when oversupply reaches the point where entire industries suffer losses but still can't exit, there must be institutional design problems.

Therefore, addressing involutionary competition also requires a multi-pronged approach. These problems weren't unforeseen—we already saw overcapacity issues in 2018-2019, but then came the pandemic, making job and employment stability the top priority. However, long-term persistence isn't viable. Protecting existing stock while increasing incremental growth prevents markets from playing their role in the survival of the fittest.

III. Expanding Opening Up

I believe our understanding here still has some issues. What problems are we actually encountering in international competition? We're facing fundamental changes in international competition that aren't directly related to who's in power or out of power. Our most important change is the shift from the vertical division of labor with developed countries to the horizontal division of labor.

In vertical division of labor, they handled high-end production while we handled low and mid-end production. Both sides' industries didn't conflict, creating few contradictions. Both sides benefited greatly from international trade—we produced clothing, shoes, toys, and bags while they produced high-end consumer goods and machinery equipment. Industries were mutually supportive.

After 2012, industrial competition between the two sides gradually intensified.

Consider Apple and Huawei. Before Huawei's final chip restrictions, global shipments reached 300 million units. We both make phones and began competing in third-party markets. More and more of our manufacturing products, starting with technology introduction from multinational companies, quickly outperformed theirs because our industrial foundation is vast and our overall economic scale is large. We now produce the world's highest and largest wind turbine blades. For shield tunneling machines, these large construction machinery units, half the world's tunnels and underground passages are dug by Chinese machinery. The more we produce, the more we learn by doing, and the stronger our capabilities become.

When multinational companies shifted from our previous non-planar, vertical division to horizontal competition, what changes occurred? The dual nature of multinational companies inevitably emerged. Previously, we had conflicts with the US. Before Trump, we had six trade wars with America, and each time we employed measures with both sides implementing some sanctions. At that time, multinational companies and US companies were anxious. Before our government negotiation teams even appeared, the China-America Chamber of Commerce organized a team to lobby Congress: "You can't sanction China—sanctioning China means sanctioning us. We need to import large quantities of components and export too." Their interests aligned then. That situation has long passed. The dual nature of multinational companies will be very long-term because the competitive horizontal relationship between China and other countries will be a long-term process.

When they come to China, they see such a large market with excellent industries, components, and processing chains that they can't bear to leave. They tell our leaders that China is very important and they'll certainly maintain friendly relations with us. Returning to America, they tell Congress that China must be contained, or there'll be no room for competition. There are too many examples, and they don't hide it. Currently, major powers worldwide have no conspiracies—everything is on the table, and everyone sees very clearly. This is the basic logic of intensified competition, not directly related to who's in power or out of power. It's just that some people act without method—that's the only way to describe it—they don't know how to act properly. They didn't devise this themselves; it's caused by fundamental changes.

The central leadership has repeatedly emphasized high-level opening up. I don't have time to elaborate today, but from China's future modernization construction perspective, the multi-faceted requirements for opening up are extremely important. Given China's competitiveness, we can still maintain competitive advantages in a very open environment.

Let me address a current social misunderstanding. Professor Li Yang mentioned international "fragmentation" and "stagnation" earlier. Actually, this statement was generally correct before 2022, but after the pandemic, all four major globalization indicators launched simultaneously. Take international trade as an important example—this shows global trade as a percentage of global GDP. During the first 40 years of our reform and opening up, the proportion of global trade to global GDP continued to rise, which is the most important indicator of globalization. Globalization was developing vigorously.

After the 2008 financial crisis, the proportion of global trade to global GDP stabilized with some decline. If we must quantify this period, it represents stagnation or deceleration in globalization. During the pandemic years 2020-2021, it fell to the lowest point in 16 years, indeed showing some retreat. Starting in 2022, global trade experienced very significant growth. How significant? It reached a historical high never seen before: 61.24%. The previous high was 61.05% in late 2008. The proportion of global trade to global GDP reached the highest point in history. How can we say globalization is retreating?

2023 data hasn't been updated, but I estimate it's around 58-point-something percent, which is also a historical high point. Therefore, global trade after the pandemic is recovering rapidly—this isn't just quantity but proportional improvement. Several other major indicators include the multinational corporation global division of labor index and the overseas proportion of multinational corporation R&D investment. All three indicators are rapidly recovering. So while our experience isn't good and others intentionally suppress us unfairly, we must see the external world clearly—it's still developing rapidly.

Beyond globalization driving factors, there's one most important new driving factor: digitalization. The right side of the chart shows the world's largest 100 digital multinational companies. The middle shows the relationship between overseas investment, overseas employees, and overseas proportions in the three years before the pandemic. During the pandemic, not only did this not slow down, but it actually accelerated.

Digital products in cyberspace make "far away" the same as "close by"—it's an inherently global technology. After our "Black Myth: Wukong" went online, domestic and overseas players could play it equally on the same day. It's not produced domestically first then exported—it's an instantaneous globalization process.

DeepSeek currently has domestic and foreign users split equally, with 67 countries using our product. Therefore, the increased proportion and rapid development of digital and intelligent technologies globally will rapidly enhance globalization.

China-US Economic and Trade Relations: Considerable Negotiation Space Exists

I believe China-US economic and trade relations still have considerable negotiation space. After announcing additional tariffs on April 2, we began the first round of negotiations on May 12. On June 9, we signaled that both sides have negotiation space. By "space," we mean that both sides' demands are somewhat misaligned, and misalignment creates possibilities for mutual agreement. The US wants to resolve large trade deficits, while we want to open technology and market cooperation. Looking at official photos from both sides, how should I put it? Although it appears no agreement was reached, they're full of optimistic expectations, so considerable negotiation space remains ahead.

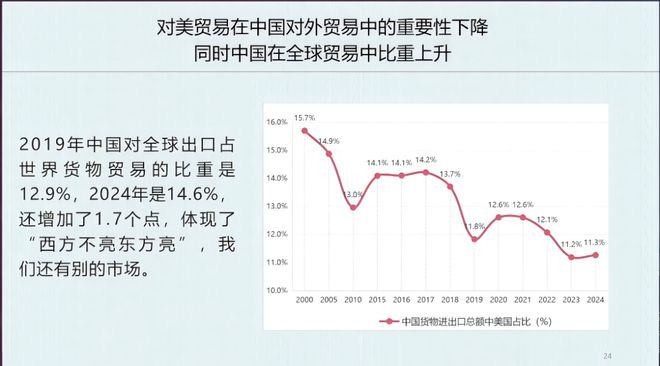

First, China's export trade proportion to the US is declining. Our world trade diversification has been very effective over these years. Trade cooperation with the US would certainly be better given our strong complementarity, and our products have stronger complementarity with developing country products. But even with problems, the US position isn't that important for China. The importance of US trade in China's foreign trade is declining—from about 15.7% in 2000 to about 11% now. China's share of global exports was 12.9% in 2019 and 14.6% in 2024, reflecting that we have other market choices.

We must also see the complexity of international trade. Government intentions and market resource allocation processes aren't always consistent. Sometimes they align—for example, when the US wants to attack China's IT industry and enterprises also want to attack it. In the May 8 AI hearing, US AI enterprises' demands included establishing technology alliances to contain China, which aligns with their government's thinking.

However, they're often inconsistent. Two examples: The left chart shows the proportion of US investment in Chinese enterprises' overseas investments. Despite the US being so unreasonable toward China and such major China-US disputes in recent years, our investment in the US has continued rising because Chinese investors still consider the US market worthwhile.

The right chart shows listing locations for venture capital enterprises. Despite our current situation, the proportion of Chinese venture capital enterprises listing on US stock markets in 2024 has increased dramatically compared to before. Of course, some consensus between both countries' regulatory agencies is important. You see how willing US investors are to invest in Chinese startups, or how willing Chinese startups are to list on US stock markets—there's still mutual recognition of industries and development. We couldn't have imagined this then. Sometimes, government judgments and market judgments aren't entirely consistent. International trade is quite complex, and markets still play particularly important roles in cross-border resource allocation. This is our basic judgment.

Multinational Corporations' Dual Nature: Cooperation Willingness and Competitive Pressure

They have both cooperation willingness and competitive pressure. They're closing Chinese branches because they can't compete with us—most multinational companies can't compete in China now. Competing with our leading enterprises has become difficult, but withdrawal didn't start recently. Home appliance enterprises began in 2004, Nokia left in 2007. Construction machinery companies like Caterpillar and Komatsu find competing for China's mid-range and even high-end markets quite difficult. LED panels started leaving in 2009. In e-commerce, Amazon came to China hoping to compete with local Chinese market and local brands—how could they compete? Now it only brings Chinese goods overseas. So many sectors didn't start recently.

Of course, multinational companies won't say this—they just echo our talking points about various investment environment problems. More than half leave because they can't win, since I've studied multinational companies for forty years and understand these enterprises too well. But they don't say they can't win; they just say they're leaving. Of course, considerable portions also involve international geopolitical issues.

Certainly, our investment environment has some problems. International, market-oriented, and law-based international investment environments need further improvement, but we shouldn't attribute multinational company departures entirely to ourselves—it's really not like that. Our competitiveness is much stronger now than before.

Confidence in China's long-term growth still exists: innovation capabilities, super-large-scale competitive system advantages, human capital advantages, and digital economy development. The digital economy represents a particularly important opportunity for China. The digitalization and intelligentization I mentioned earlier represent replication, reuse, and reproduction economics, where large-scale market advantages are particularly prominent.

Our "Nezha 2" alone in China's single market could reach fifth place in the global box office—this epitomizes the digital era. Anyway, producing an animated film costs the same whether 70 million people in the Korean-speaking world watch it or 1.5 billion people in the Chinese-speaking world watch it—this scale economy is most significant.

Other manufacturing scale economies mean that even if your automotive enterprise scale is large, you still must produce cars one by one. The digital economy is replication, reuse, and reproduction economics, where large-scale economic systems have particular advantages. Our opening capabilities are completely different from before.

How fortunate China is to have such high-level specialists to shape its policies and draft its regulations. Talk about a deep bench!

While the Us wants to reguläte and control the whole world and gets involved in 1000*+1 foreign affairs, Chinas stratetic think Tanks focus on intelligent Investments to Overtake the Power in severe regions all over the Planet. Developing and economic Help for 3.world regions will Open the markets for seldom earths and other important recources. No endless conflikts (Not even Taiwan) can slow down the Economic Progression. A Story of success!