How Do Chinese Local Governments Manage Their Development Zones?

A Study from the Report of the Luoyang Government Policy Research Office

For today’s episode, I want to go deeper into how the Chinese local governments manage their development zones. I’ve read a research report by the Luoyang Municipal Committee Policy Research Office, an office within the local government structure of Luoyang, a city in Henan Province. I believe this report is valuable for two reasons.

It provides a rare practical angle to observe how the Chinese local governments manage their regional economic development. Actually, It’s the first time I’ve observed a local government office publish such kinds of research reports. I think it could represent the general view cause, in terms of demographics and economic development, Luoyang is more similar to regular medium-sized Chinese cities than coastal cities on the Chinese east coast.

This report mentioned the reality that some of these supporting companies in development zones are actually local government financing vehicles (also known as LGFVs). In China, over-reliance on LGFVs has been one of the major reasons for the large amount of local government debt. Reading through the report, I can see that Luoyang governments are managing to move away from relying on LGFVs to gather funds for operations.

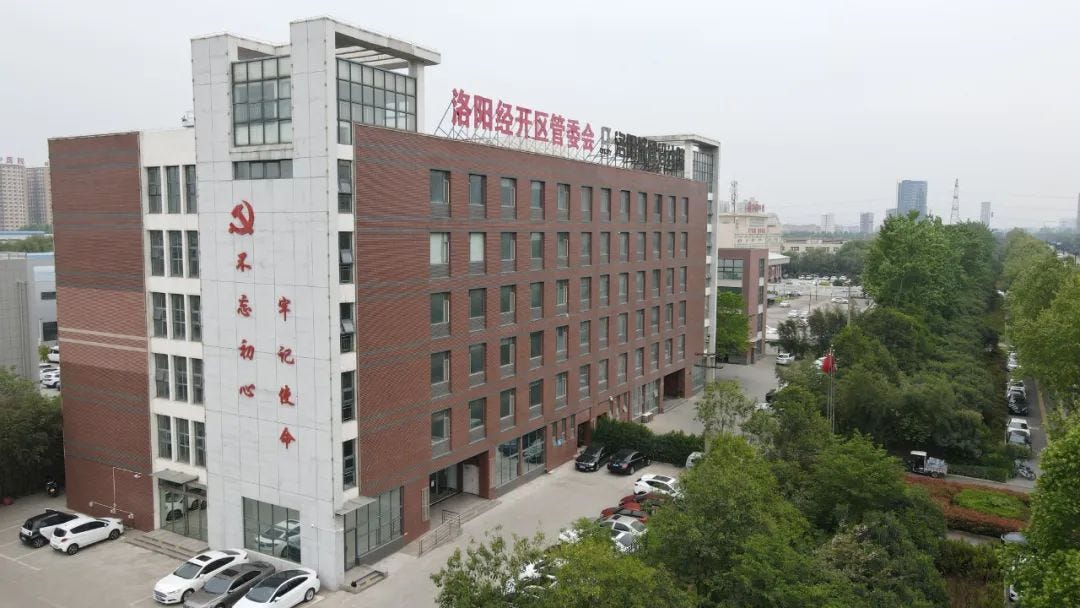

Luoyang Economic and Technological Development Zone Management Committee

What is a Development Zone?

First, some background info: Development Zones in China are designated areas established by the government. These zones provide a comprehensive range of benefits to attract investment, including well-developed infrastructure, pre-allocated land, and efficient one-stop services. By setting up operations within a development zone, businesses can circumvent the complexities and higher costs associated with investing outside these areas. The convenience and support offered by development zones help mitigate logistical challenges and bureaucratic hurdles.

There are three bodies in the development zone:

The management committee is responsible for policy formulation, planning, administrative approval, and other administrative management functions. It is subordinate to the county/district government.

The operating company. Focusing on investment promotion, enterprise services, daily operations, infrastructure construction, etc. It’s invested by the county/district finance or the local state-owned assets Supervision and Administration Commission (SASAC). And many of these operating companies have become the LGFV, which is partially responsible for the local government debt.

The county/district government has management and supervisory responsibilities over the development zone management committee and the operating company.

Operation Models of Development Zone Operating Companies

Debt is not necessarily a problem as long as you use it wisely to generate more interest income than the interest expense. The report mentioned four models that generate interest for operating companies. Most operating companies employ at least two of these models below.

园区投资开发商、园区运营服务商、园区产业投资商、园区金融服务商四种模式,运营公司一般将各模式复合叠加、综合发展。

Investing in area infrastructure

It’s a long-term and capital-intensive approach. Under this model, the management company primarily acts as the main body for area investment and construction. They acquire land and build standardized factory buildings, talent apartments, office buildings, and other facilities, which are then sold or leased to enterprises entering the region at market prices. This approach allows the management company to generate operating income while helping enterprises quickly start production.

Example 1: Wuhan East Lake High-tech Development Zone Management Company (East Lake High-tech Group) follows the park investment and development model. They constructed Wuhan's first industrial park, the International Enterprise Center, by acquiring land for research and development purposes and investing in the construction of R&D buildings, industrial plants, and other facilities. These properties were then offered to high-tech enterprises at lower rents or sales prices to attract them to the park. Currently, East Lake High-tech Group's investment and development business has gradually expanded nationwide, ranking among the top 10 industrial parks in China for six consecutive years.

Example 2: Xi'an National Civil Aerospace Industrial Base Management Company (Urban Development Group) attracted Longi Company's 5GW monocrystalline solar cell production project to the park. The management company first invested in and constructed factory buildings and power systems according to the enterprise's requirements. Upon completion, these facilities were leased to Longi Company, providing the management company with stable rental income while reducing costs for Longi Company. This arrangement allowed Longi Company to focus its capital and energy on technology research and development and process improvement, ultimately increasing its production capacity from 5GW to 135GW.

Operation and Service Provider Model

It’s still a long-term model but with a light asset. In this model, the development zone management company establishes service companies to cater to the needs of the enterprises within the area. These service companies provide comprehensive supporting services such as property management, facility maintenance, catering, human resources, and information technology. The management company generates operating income by collecting service fees.

Example 1: Suzhou Industrial Park Management Company (China-Singapore Group) considers park services as one of its essential businesses. They provide traditional public utility services, mainly focusing on water, gas, and heat and power supply. The company also offers comprehensive environmental services, including sludge, hazardous waste, industrial wastewater, and food waste treatment, as well as environmental testing. Additionally, they provide new energy services, primarily focusing on centralized cooling, distributed photovoltaics (construction and operation of rooftop photovoltaics), light source technology (energy-saving renovation of light sources), and power distribution and sales.

Example 2: Shanghai Zhangjiang Hi-Tech Park Management Company (Zhangjiang Group) has established a wholly-owned subsidiary, Zhangjiang Huicheng, to provide a series of full life-cycle supporting services to enterprises within the park. These services include property management, enterprise development, talent cultivation, energy services, municipal support, and environmental services. The company is committed to becoming a provider of industrial real estate supporting services and full life-cycle services for enterprises.

Industrial Investment Model

It's a high-risk, high-return approach. The development zone management company shifts from asset operation to capital operation. They engage in industrial investment promotion and industrial cultivation through direct equity investments or fund investments. While helping to extend and supplement the industrial chain of the development zone, the company also obtains investment returns.

Example: Suzhou High-tech Zone Management Company (Suzhou High-tech Group) focuses on high-tech industries such as green and low-carbon technologies and medical devices. They have established five self-operated funds and invested in 11 funds as a limited partner. In 2023 alone, they invested in more than 50 equity projects, with a cumulative investment amount of 4.756 billion yuan and an annual investment return of 491 million yuan, an increase of 80.17% year-on-year.

Financial Service Provider Model

This model has lower risk than direct investment. The operating companies provide financial services such as supply chain finance, commercial factoring, financial leasing, and small loans to support the growth of enterprises within the area while obtaining considerable service fees.

Example 1: Jinan High-tech Zone Management Company (Jigao Holding) established Jinan High-tech Finance Company to provide financing guarantees and small loans to enterprises in the park. They have served more than 700 enterprises and provided nearly 4 billion yuan in financing guarantees, effectively expanding financing channels for enterprises.

Example 2: Shanghai Free Trade Zone Lingang New Area Management Company (Lingang Group) collaborated with financial institutions like Shanghai Rural Commercial Bank to launch the "Lingang Park Science and Innovation Loan" service, catering to the unique characteristics of sci-tech enterprises in the park. As of the end of 2023, the cumulative loan amount exceeded 10 billion yuan, benefiting more than 700 enterprises and effectively meeting the financing needs of sci-tech enterprises.

Example 3: Shenzhen Bay Science and Technology Park Management Company (Shenzhen Bay Technology Company) built a financial service platform (SIHC Financial Supermarket) and cooperated with more than 30 financial institutions to provide park enterprises with financial services and products in banking, securities, insurance, guarantees, funds, and venture capital, effectively solving financing difficulties for park enterprises.

The report also mentioned many existing problems of the development zones. It put the lack of market-oriented operations at the top of the problem list. The report said that most operating companies are established based on the original platform companies. Some counties/districts have a biased understanding of the operating companies' positioning and still regard them as simple government financing platforms.

各开发区运营公司基本都是依托原有平台公司组建的,部分县区对运营公司定位的认识有偏差,仍然简单地把运营公司看作政府融资平台,没有从有利于市场化运营的角度理顺体制机制,阻碍了公司市场化发展。

From my perspective, at least at the local level, the Luoyang gov wants more than easy money brought by LGFV; it choose the hard way and actually wants to cultivate some real high-tech enterprises.

(I) Operating companies' investment and financing capabilities are relatively weak. Due to historical factors, operating companies generally have issues such as few operating assets and a low level of specialization in capital operations.

Some operating companies have exclusive water supply and gas rights within the development zone, while others face issues such as poor asset liquidity and low operating income.

Although some operating companies have established industrial guidance funds, they generally lack fund operation experience and suffer from poor management. The role of the funds is not fully utilized, and revenue is still unable to cover financing principal and interest.

The cooperation mechanism with professional operators is not sound, and the role of professional operators is not fully utilized.

(II) The enterprise system of operating companies is not sound. Operating companies still have a strong administrative management style, and the governance system, personnel, and salary systems need to be improved.

The corporate governance system is not sound, with some operating companies not having established a board of directors, and those that have established one have issues with the board not fully exercising its powers and duties.

The employment mechanism is not sound, and there is a shortage of business management talents and professional personnel.

The salary distribution mechanism is not sound, with some operating companies still implementing the salary system of administrative institutions, and those that have established a market-oriented salary system have issues with salaries not fully reflecting job value and individual contributions.