Article Share- Has the Consumption of China's Wealthy Middle Class been Exaggerated?

Lessons from Household Survey Data Shows China's Prosperous Middle Class's Consumption May Not as Important Than Lower-Income Class

For a period, people both in and outside China viewed the increasing domestic consumption as the result of the expansion of the Chinese middle class. Many people expect the middle class to help the Chinese economy rebalance toward more consumption-led. However, data tells a different story; the lower-income class, not the middle class, contributed the most toward the general consumption increase, which is about 54%. The middle class itself contributed about 22% of the increase in aggregate consumption. I think that data also helps explain the success of online retailers like PDD(拼多多), which target lower-tier markets such as small cities and rural areas. PDD even expanded its business in the US, known as Temu.

For today’s episode, I bring the article published online in September 2023 by The China Quarterly, the top-tier journal about China. The article titled China's Prosperous Middle Class and Consumption-led Economic Growth: Lessons from Household Survey Data. It’s a joint work by Xiuna Yang, Terry Sicular, and Björn Gustafsson.

Yang Xiuna(杨修娜) is an associate research fellow at the China Development Research Foundation. She obtained her PhD from the Business School of Beijing Normal University. Her research investigates aspects of labor economics in China, including income distribution, the middle-income class, and labor migration.

Terry SICULAR is a professor emerita of economics at the University of Western Ontario, Canada, and a research associate at the SOAS China Institute. Her recent research investigates aspects of income distribution in China, including inequality, poverty, and the middle-income class.

Björn A. GUSTAFSSON is a professor emeritus of the Department of Social Work, University of Gothenburg, Sweden. He is also a research fellow at the Institute for Labour Economics (IZA), Bonn, Germany, and a fellow of the Global Labor Organisation (GLO). He joined the China Household Project (CHIP) in the 1990s and has published widely in economics and China studies journals.

For the full article, please visit: https://www.cambridge.org/core/journals/china-quarterly/article/chinas-prosperous-middle-class-and-consumptionled-economic-growth-lessons-from-household-survey-data/1B426D4B9918A2688A43ED49AED7D67A

Article Abstracts

After examining macro and micro data, researchers only observed growth in aggregate consumption but didn’t find evidence of consumption-led growth. They found that although the size of the middle-income group has expanded rapidly, its contribution to overall consumption growth has been lower than expected. Constrained by some of its own characteristics (social welfare, etc), the middle-income group has not yet fully realized its potential to "boost consumption and drive economic growth." For example, the middle-income group mainly comes from a limited range of people, and its consumption rate is relatively low. While the expansion of the middle-income group will promote "economic rebalancing" it is not yet sufficient.

Increasing Prosperous Middle Class

The size of the Prosperous middle class in China has increased from 10.1 million in 2002 to 292.3 in 2018. Its share of the Chinese population also vastly increased, from less than 1% in 2002 to over 20% in 2018. Also, this increase is more of an urban phenomenon. In 2018, about 49% of the lower-income class was rural, but less than 10% of the prosperous middle class was rural. The prosperous middle class relies heavily on income from employment, with many benefiting from well-paid formal jobs and having higher education levels compared to the lower-income class. Shrinking employment in manufacturing and construction sectors, which previously provided upward mobility opportunities for low-income workers with lower education levels, poses a challenge for the future expansion of the prosperous middle class.

Middle-Class Consumption Situation

In terms of absolute consumption, China's prosperous middle-class households spend more on consumption than lower-income households, with a gap of about 46,000 yuan in 2018. However, the consumption gap between the top third of the lower class and the bottom third of the prosperous middle class is smaller, at 31,000 yuan per year.

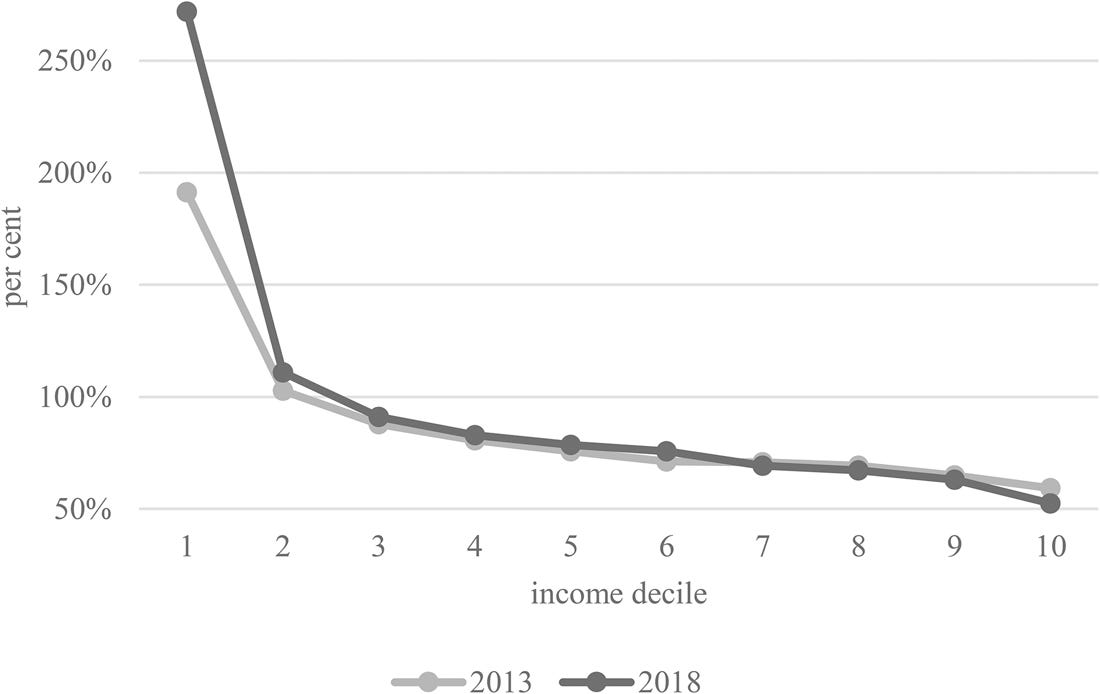

The average propensity to consume (APC), which is the share of household income spent on consumption, was 57% for prosperous middle-class households in 2018, considered extremely low by international standards. In contrast, the APC of lower-income households was 85%, and this difference in APCs between the two classes has widened over time. The difference in APCs reflects the underlying relationship between income and consumption across the income distribution in China, where the share of savings increases and the share of consumption declines as household income rises. The APC curve by income decile shows that the poorest households consume more than their income (APC > 100%), while the richest households consume about half and save about half of their income (APC ≈ 50%).

Household APC by Income Decile (%) Source: Authors’ estimates using the CHIP data.

Contribution of Prosperous Middle Class to the Growth of Consumption

Data reveals that the increase in aggregate consumption was mainly due to the growth in national average household consumption (93.5%), while the growth in the population of households contributed less than 7%.

By further decomposing the increase in national average household consumption, It shows that 54% of the increase was contributed by consumption growth within the lower-income class (Probably due to the poverty reduction projects in recent years), while 34% was contributed by the movement of households from the lower-income class into the prosperous middle class. By calculation, results show the expansion of the prosperous middle class contributed 32% of the increase in aggregate household consumption from 2013 to 2018.

In the model of a realistic scenario, researchers believe the expansion of the prosperous middle class contributed 22% of the increase in aggregate consumption.

In conclusion, the authors find that the expansion of China's prosperous middle class contributed at most a third, and more likely about a fifth, of the growth in aggregate consumption between 2013 and 2018. This contribution was considerably smaller than the contribution of rising consumption within the lower-income class.

Conclusion

Efforts to rebalance should not overlook the lower-income class, as their income growth has the biggest impact on aggregate consumption due to their large population and relatively high propensity to consume.

The recent rapid expansion of China's prosperous middle class may be difficult to sustain in the long term, as future expansion will require promoting income growth for rural, less-educated, and non-formal sector workers.

The low propensity to consume of China's prosperous middle class limits its ability to drive aggregate consumption growth. Rebalancing requires measures that enable these households to consume a higher share of their income, such as improvements in pension and social welfare programs, access to education, and financial sector reforms.

The coronavirus pandemic has led to weak economic performance, a drop in the average propensity to consume, and sluggish household income growth. If these trends continue, they could hinder the expansion of the prosperous middle class.

China faces long-term challenges to consumption-led growth, including rapid population aging and urbanization. While population aging may lead to higher average propensities to consume, it can also slow household income growth. Urbanization may not boost aggregate consumption as expected, as urban households have a lower propensity to consume compared to rural households.

To achieve sustained consumption-led growth, China needs to implement economic reforms that enable households to rebalance consumption and saving at the micro level, such as reforms in social welfare policies, the hukou system, and financial and housing markets.